Percents: Understanding Credit Card Debt Worksheet for Students - Scenario 3

CreativeMathLessons

343 Followers

Description

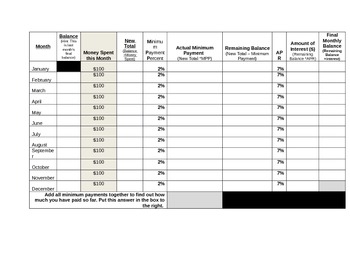

This chart covers the following scenario:

"Capital One offers a special credit card for teens. It has a spending limit of $100 per month and a very low monthly payment of 2%. The APR for this card is also pretty low at 7%. You talk to your parents and they agree that it sounds safe so they cosign the card with you. You now have your own credit card to use for monthly purchases and do not have to constantly ask your parents for money. You will owe your parents the remaining balance at the end of the year. Use your sheet to determine if you should get this credit card or stick with your cash allowance. "

The chart is a great way for students to discover, by hand, the problems with only paying the minimum balance on a credit card. I suggest going over a couple of rows with them so they understand how the chart works.

This chart can be used as a stand alone activity or with the other scenarios I have listed. It would be particularly helpful to use the Excel Debt Calculator that I have listed as well. Please feel free to email me if you have any questions.

Credit Card Debt Worksheet - Scenario #3 by Dana Burrows is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

"Capital One offers a special credit card for teens. It has a spending limit of $100 per month and a very low monthly payment of 2%. The APR for this card is also pretty low at 7%. You talk to your parents and they agree that it sounds safe so they cosign the card with you. You now have your own credit card to use for monthly purchases and do not have to constantly ask your parents for money. You will owe your parents the remaining balance at the end of the year. Use your sheet to determine if you should get this credit card or stick with your cash allowance. "

The chart is a great way for students to discover, by hand, the problems with only paying the minimum balance on a credit card. I suggest going over a couple of rows with them so they understand how the chart works.

This chart can be used as a stand alone activity or with the other scenarios I have listed. It would be particularly helpful to use the Excel Debt Calculator that I have listed as well. Please feel free to email me if you have any questions.

Credit Card Debt Worksheet - Scenario #3 by Dana Burrows is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License.

Total Pages

1 page

Answer Key

N/A

Teaching Duration

N/A

Report this resource to TPT

Reported resources will be reviewed by our team. Report this resource to let us know if this resource violates TPT’s content guidelines.