Federal Government Budget Simulation

- Google Sheets™

- Excel Spreadsheets

What educators are saying

Description

Make changes to the tax code and government spending to reduce the deficit while keeping your approval rating above 50%.

No paper needed. Student's only need access to google sheets!

-

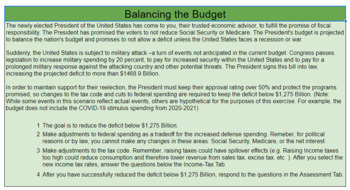

The newly elected President of the United States has come to you, their trusted economic advisor, to fulfill the promise of fiscal responsibility. The President has promised the voters to not reduce Social Security or Medicare. The President's budget is projected to balance the nation's budget and promises to not allow a deficit unless the United States faces a recession or war.

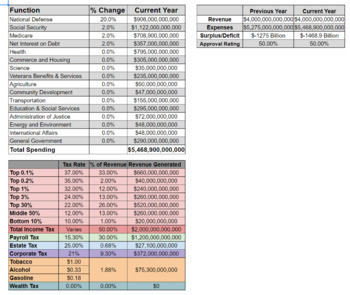

Suddenly, the United States is subject to military attack –a turn of events not anticipated in the current budget. Congress passes legislation to increase military spending by 20 percent, to pay for increased security within the United States and to pay for a prolonged military response against the attacking country and other potential threats. The President signs this bill into law, increasing the projected deficit to more than $1468.9 Billion.

In order to maintain support for their reelection, the President must keep their approval rating over 50% and protect the programs promised, so changes to the tax code and cuts to federal spending are required to keep the deficit below $1,275 Billion. (Note: While some events in this scenario reflect actual events, others are hypothetical for the purposes of this exercise. For example, the budget does not include the COVID-19 stimulus spending from 2020-2021)

1. The goal is to reduce the deficit below $1,275 Billion (1.275 Trillion) while keeping the President's approval rating above 50%.

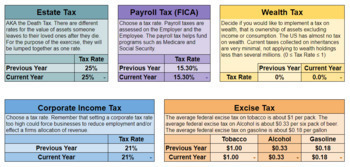

2. Make adjustments to federal spending as a tradeoff for the increased defense spending. Remember, for political reasons or by law, you cannot make any changes in these areas: Social Security, Medicare, or the net interest.

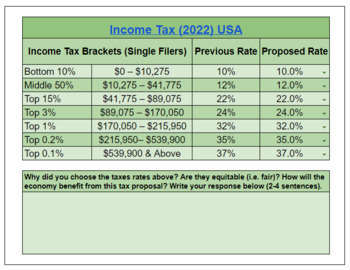

3. Make adjustments to the tax code. Remember, raising taxes could have spillover effects (e.g. Raising Income taxes too high could reduce consumption and therefore lower revenue from sales tax, excise tax, etc. ). After you select the new income tax rates, answer the questions below the Income-Tax Tab.

4. After you have successfully reduced the deficit below $1,275 Billion, respond to the questions in the Assessment Tab.