Calculating Net Income | Paychecks, Payroll Taxes & Deductions | 2023+ Updates

- Zip

What educators are saying

Also included in

- Income tax is one of the harder topics to teach in a personal finance curriculum and often one of the least exciting for students. We know how important it is, but it's hard to get excited about spreadsheets and percentages sometimes! This bundle is packed full of hands on resources to make understaPrice $27.99Original Price $56.95Save $28.96

Description

This purchase includes ALL future updates for upcoming tax years. I will update this resource annually to reflect the new filing data and limits. I typically add more features and resources each year based on your feedback. Buy now to lock in all those updates!

If you just want the 2023 filing year and no updates, you can find it here.

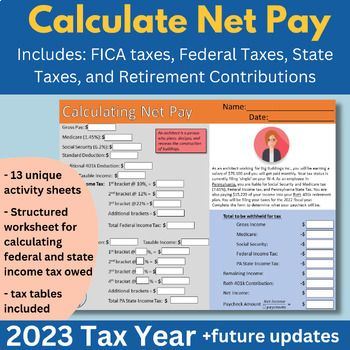

Taxes... am I right? It's a traditionally hard topic to teach where students can get lost in the math and calculations of our federal and state tax bracket system. This resource is here to help! Students will be given a salary (gross pay), filing status, state of residence, paycheck frequency, and 401k contribution (Traditional and Roth!) which they will have to use to determine how much money they can expect to get in their paychecks.

This hands-on activity allows students to see how FICA taxes are calculated, what happens in the bracket system at the federal and state level, and how Traditional or Roth retirement (401k, IRA, 403b, 457, TSP) contributions impact taxable income as well as paycheck amounts.

Full walk-through of the resource and how it works for students

Compared to the 2022 version, updates this year include:

- Tax tables updated for the 2023 filing year.

- Updated video walk-throughs of a federal and state income tax example calculation linked on each worksheet. (See example)

- Video visual explanation of how federal income tax brackets work using 2022 numbers.

The resource also includes:

- 13 different activity sheets for students to complete.

- 2023 tax tables for federal and 6 states.

- Answer Key

- 2022 Calculating Net Income Resource

For related activities check out my Income Tax Bundle and:

Parts of a Paycheck Definitions Crossword Activity

Federal Income Tax Visualization Activity for 2023 Filing Year

Federal and State Income Tax Guided Worksheets

Absolutely loved this purchase. My students thought the instructions were easy to understand and the activities were explained in a way that made it easy for them to complete the assignments.

— Salina D. (Rated 5 out of 5)

This is an outstanding resource for my students, one of the best I have purchased on this site (and I have purchased over 250!).

— Stephanie York [TPT Seller] (Rated 5 out of 5)